The ABC’s of Debt Reduction

Prairie Eco-Thrifter

MAY 22, 2011

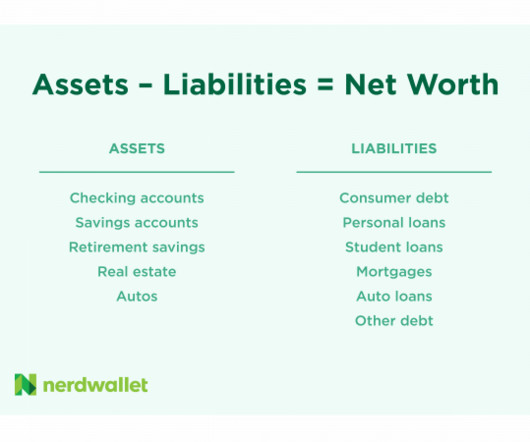

Regardless as to the specifics, many Americans have elected to decrease spending, increase savings and eradicate debt. Fortunately, there is no one size fits all plan to debt reduction. While this may be one of the quickest ways to sock away money for the purpose of debt reduction, it’s likewise the least pleasurable.

Let's personalize your content